In 2023, professionals in alternative asset management, including hedge funds, saw a 35% increase in average total compensation, reaching $1.4 million. What are the top skills needed for hedge fund analyst jobs in the era of AI?

The U.S. hedge fund market was valued at $103.1 billion in 2021, employing approximately 86,912 individuals across 3,691 businesses. Hedge funds are key players in the financial world, offering high-risk, high-reward investment opportunities for wealthy individuals, institutional investors, and other stakeholders. At the core of these operations are hedge fund analysts, professionals tasked with evaluating potential investments and providing insights to fund managers.

In 2023, professionals in alternative asset management, including hedge funds, saw a 35% increase in average total compensation, reaching $1.4 million. This surge was particularly pronounced in private credit and private equity sectors.

There’s an increasing demand for professionals with advanced degrees, particularly PhDs, in quantitative fields. These individuals command up to 50% higher compensation compared to peers without such qualifications, driven by the industry’s focus on machine learning and AI-driven trading strategies.

This article explores the nature of hedge fund analyst jobs, their responsibilities, required qualifications, career progression, and current trends in the field.

Who is a hedge fund analyst?

A hedge fund analyst is a financial professional responsible for conducting in-depth research and analysis to support investment decisions. Working in hedge funds, which are private investment funds utilising diverse strategies to maximise returns, analysts evaluate potential investment opportunities, monitor portfolio performance, and provide data-driven recommendations.

Hedge fund analysts often specialise in specific asset classes such as equities, fixed income, derivatives, or alternative investments like real estate or commodities.

Key responsibilities of hedge fund analysts include:

- Research and analysis:

- Conduct in-depth research on financial markets, industries, and companies.

- Analyse financial statements, market trends, and economic data.

- Develop financial models to predict future performance.

- Idea generation:

- Identify undervalued or overvalued assets.

- Suggest potential investment strategies based on research findings.

- Portfolio monitoring:

- Track the performance of current investments.

- Recommend adjustments to the portfolio based on market conditions.

- Communication:

- Prepare detailed reports and presentations for fund managers.

- Communicate insights effectively to support decision-making.

Skills and qualifications of hedge fund analyst

- Academic background: A strong academic foundation is essential for a career as a hedge fund analyst. Most professionals hold a bachelor’s degree in finance, economics, accounting, or a related field. Degrees in mathematics, statistics, or engineering are also common, especially for roles requiring quantitative analysis. Many analysts pursue advanced qualifications such as:

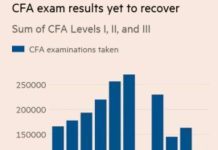

- Chartered Financial Analyst (CFA) certification, which is highly regarded in the investment industry.

- Master’s degrees, particularly an MBA or a master’s in finance or economics.

- Technical skills

- Financial modelling: The ability to build and interpret complex financial models is crucial.

- Valuation techniques: Proficiency in discounted cash flow (DCF), comparable company analysis, and other valuation methods is often required.

- Quantitative analysis: Familiarity with statistical and mathematical models is important, particularly in quantitative hedge funds.

- Programming skills: Knowledge of programming languages like Python, R, or SQL can be advantageous for analysing large datasets.

- Soft skills

- Critical thinking: Hedge fund analysts must assess risks and make sound recommendations.

- Attention to detail: Small errors in analysis can lead to significant losses.

- Communication: Analysts need to convey complex information clearly and concisely.

- Time management: Meeting tight deadlines is a common aspect of the job.

Career path for hedge fund analyst

Entry-level positions: These roles provide exposure to financial modelling, valuation techniques, and market analysis, laying the groundwork for transitioning into hedge fund positions. Most hedge fund analysts begin their careers in entry-level roles such as:

- Investment banking analysts.

- Equity research associates.

- Private equity analysts.

Junior Analyst: Junior analysts typically assist senior analysts or portfolio managers. They conduct research, build models, and prepare reports. This stage is often considered an apprenticeship period where they gain a deeper understanding of hedge fund operations.

Senior Analyst: After gaining experience, professionals can progress to senior analyst roles. Senior analysts take on greater responsibilities, such as managing a segment of the fund’s portfolio or mentoring junior analysts.

Portfolio Manager: The ultimate goal for many hedge fund analysts is to become a portfolio manager. In this role, they are responsible for managing significant portions of the fund, making investment decisions, and directly influencing the fund’s performance.

Partner or Principal: At the highest level, analysts may advance to become partners or principals, owning a share of the hedge fund and having a say in its overall strategy.

Compensation and benefits of hedge fund analyst

Hedge fund analyst jobs are known for their lucrative compensation packages, which typically include a base salary, performance bonuses, and sometimes equity or profit-sharing. Salaries can vary depending on the fund’s size, location, and the analyst’s experience.

- Entry-level analysts: Base salaries usually range between £60,000 and £100,000 annually, with bonuses adding a significant percentage.

- Experienced analysts: Senior analysts and portfolio managers can earn several hundred thousand pounds annually, with top performers receiving bonuses that exceed their base salary.

In addition to financial rewards, hedge fund analysts often enjoy other benefits such as:

- Opportunities to work with industry leaders.

- Access to cutting-edge technology and research tools.

- Networking opportunities with high-profile clients and stakeholders.

How to enter the field of hedge fund analyst

Build a strong foundation: To succeed as a hedge fund analyst, it is essential to start with a strong academic foundation. Focus on gaining a deep understanding of finance, economics, and related disciplines through rigorous study and coursework. Developing technical skills such as financial modelling and programming is equally important, as these tools are critical for analysing data and building investment strategies. Early mastery of these areas can provide a significant advantage when pursuing opportunities in the competitive hedge fund industry.

Gain relevant experience: Relevant work experience is a key differentiator for aspiring hedge fund analysts. Internships in investment banking, asset management, or equity research offer valuable exposure to financial markets and investment processes. These roles allow candidates to develop expertise in financial analysis, valuation techniques, and market research. Entry-level positions provide practical knowledge and help build a strong professional foundation, making candidates more appealing to potential employers in the hedge fund sector.

Network: Building a professional network is crucial for entering the hedge fund industry. Attending industry conferences and joining professional organisations can open doors to valuable connections and insights. Engaging with hedge fund professionals on platforms such as LinkedIn is another effective strategy. Networking not only helps in learning about job opportunities but also provides guidance and mentorship from experienced individuals, enhancing your career prospects.

Pursue certifications: Certifications and advanced degrees can significantly boost a candidate’s competitiveness in the job market. Earning a Chartered Financial Analyst (CFA) designation demonstrates expertise and commitment to investment analysis. Similarly, pursuing an advanced degree, such as a Master’s in Finance or an MBA, can help refine technical skills and broaden industry knowledge. These qualifications highlight a candidate’s dedication and can differentiate them from other applicants.

Apply strategically: When applying for hedge fund roles, it is essential to target firms that align with your skills, interests, and career goals. Tailoring your application to showcase relevant experience, technical abilities, and achievements ensures that your candidacy stands out. Highlighting specific skills and accomplishments that match the fund’s requirements demonstrates your value and suitability for the role, increasing your chances of securing a position.

Key takeaways

- Hedge fund analysts do detailed research and analysis to help with investment decisions. They specialise in different types of investments like stocks, bonds, financial contracts, or other alternative investments.

- Their main tasks include researching markets, creating financial models, generating new investment ideas, monitoring portfolios, and preparing detailed reports to help fund managers make decisions.

- Having a strong background in finance, economics, or similar subjects is very important. Analysts need technical skills such as financial modelling, valuation methods, and programming. Soft skills, including critical thinking, attention to detail, and clear communication, are also essential.

- The career path usually starts with entry-level roles like investment banking analysts, moving up to junior and senior analyst positions, and eventually advancing to portfolio manager or partner roles.

- Hedge fund analysts earn good pay, including competitive salaries, bonuses based on performance, and extra benefits such as opportunities to network and access to advanced research tools.

- To get started in the hedge fund industry, it’s important to build a strong understanding of finance and economics, gain experience through internships or entry-level roles, network with others in the field, and earn certifications like the CFA.

- When applying for jobs, tailoring your application to highlight your relevant skills and matching the specific needs of the hedge funds you are targeting can improve your chances of getting hired in this competitive field.

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.